YOUR HOME - REAL ESTATE

Do You Lose when You Rent?

July, 2012 - Issue #93

David Rendall & As sociates of RE/MAX Santa Clarita |

So why are so many new - and seasoned - buyers wading back into the home-purchasing waters now? Many are tired of seeing their money "thrown away" via a rent payment. "It gets harder every month to write that check," shares a friend of mine. "I keep thinking, 'If I had bought a house instead, I would have paid almost $26,000 towards my mortgage this year alone.'" Says another, "I was nervous about committing to a home when my job was unstable. But the economy is growing, I'm feeling more secure at work and I don't think I'll see interest rates this low again in my lifetime." She's buying now - and she's not alone.

"We're seeing an incredible number of people moving back into the buying market," says broker-associate and Realtor David Rendall. "There was definitely pent-up demand and the combination of super-low interest rates coupled with highly-affordable homes has pushed a lot of folks off the 'fence,'" he explains. His business, David Rendall & Associates of RE/MAX of Santa Clarita, has noted a consistent trend: "Buyers are excited to see just how far their dollar can go right now. We've been honored to help a lot of people make their home-buying dreams come true."

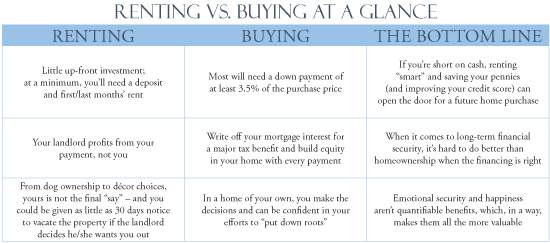

So, is buying always best? Not necessarily. "I advise individuals with low credit scores to rent for a year or two to build credit and save money in order to eventually have a bigger down payment at the ready. If you're uncertain as to whether or not you'll be putting down roots in a community longer-term - say, you may be there less than a year - renting may be a smarter move. Otherwise, the question is not, 'Can I afford to buy?' The question becomes, 'Can I afford not to?'"

|

David Rendall & As sociates of RE/MAX Santa Clarita have provided their clients with exceptional service and value for over a decade. Call or visit their office at 27720 Dickason Drive in Santa Clarita. Call their office for a free consultation or go to www.renterstool.com for acces s to the free "Rent versus Buy" calculator. The site also gives you acces s to all available rentals and properties for sale in our marketplace. 702-4550 702-4500

|

||||||||||||||||||||||||||||